|

Employee Master |

|||

|

Employee Group |

Employee Category |

Employee |

|

|

Payroll

Master |

|||

|

Payroll Unit |

Attendance/ Production Type |

||

|

Salary

Details |

|||

|

Individual Pay Structure |

Group Pay Structure |

||

|

Payroll

Process |

|||

|

Attendance Process |

Payroll Process |

Payroll Reports |

|

Activating Payroll in Tally Prime

Activate the payroll feature of Tally Prime is a simple

process.

GOT à

F11 à Maintain Payroll-Yes à Enable Statutory

Payroll à

Yes.

After activation of payroll option as above, these option

will appear under master creation as shown below:

Creation of

Employee Master

1.

Creation of Employee Categories

An Employee category provides an additional level to

classify employees in a logical manner. It is used to classify employees by

further level.

GOT> Create> Employee Category

Note: An Employee category can also be used to track the

salaries paid to the employees working in specific projects or locations. For

example: Head Office & Reginal offices.

2. Creation of Employee's Groups

Group is used to classify the employees as required.

Generally, Employees can be

classified based on function, department, location,

designation and various other

parameters using Employee Groups.

GOT> Create> Employee Group

|

Dept |

|

Accounts |

|

CRM |

|

Sale & Mkt |

|

R & D |

Note: Multiple Group can be created through single

screen by chart of account.

3. Creating Employees

Employees master stores important data regarding employees

like general info.,

statutory details, Payment details, Passport & VISA

details, Contract details etc.

GOT> Create> Employee

HEAD OFFICE

Same as

create for others.

Note: The

date of retirement/ resignation option will be available in employee alteration

screen only. Once the date of resignation/ retirement is entered, you will get

an option to select a reason for leaving also. Date of birth will be used to

find if the employee is a senior citizen and gender will be used for the

correct Income Tax computation [based on the slab].

4.

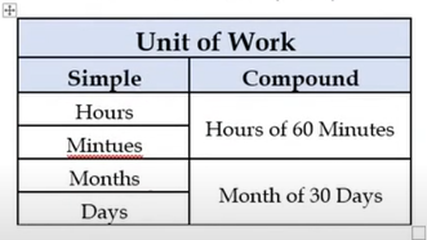

Creation of Payroll Unit

Payroll

unit are used to measure attendance or production types namely time, work or

quantity. Hence further units are used to calculate Pay Components of

Employees. It can be simple and compound both.

GOT>

Create> Units (Work)

5.

Creating Attendance / Production Types

Attendance

or Production Types are used to record the attendance and production data of employees.

Further basis on the attendance type different pay components of employees are calculated.

The

attendance/ production type may be:

ü Attendance/ Leave with pay: Should be used to record the

positive attendance and leave with pay. [ For Example: Present, Sick Leave

etc.]

ü Leave without pay: Should be used to record negative

attendance. [ For example: Absent, Leave without pay etc.]

ü Production Type: Should be used to record the

production details. [For example: Piece Production, Overtime Hours, and so on]

ü User Defined Calendar Type: Should be used to create user

defined calendar which can be later used to specify the variable number of days

for each month. [For example: 25 days in january, 24 days in February, 26 days

in march and so on]

GOT>

Create> Attendance/ Production Type

6.

Creating Earning Pay Heads:

The salary

components constituting pay structures are called Pay Heads. A Pay Head may be

an earning which is paid to an employee, or a deduction, which is recovered

from his/ her salary. The value of these Pay Heads could be either fixed or

variable, for each Payroll period.

GOT>

Create> Pay Heads

EARNING PAY HEADS

|

Pay Head |

Under |

awl Net Salary |

Name in Pay Slip |

Use for Gratuity |

Calculation

Type |

Calculation Period/Production Type |

|

Basic |

Indirect Expenses |

Yes |

Basic |

Yes |

On Attendance |

Month (As per Calendar period) |

|

House Rent

Allowance |

Indirect Expenses |

Yes |

HRA |

No |

As Computed Value Month |

(40% on Basic) |

|

Conveyance

Allowance |

Indirect Expenses |

Yes |

CA |

No |

Flat Rate |

Months (As

per Calendar Period) |

|

Overtime |

Indirect Expenses |

Yes |

OT |

No |

On Production |

Overtime |

|

Incentive |

Indirect Expenses |

Yes |

INCNTV |

No |

As User

Defined value |

-- |

Notes

Create the Following ledgers:

Capital -35000, HDFC Bank- 325000, Loan from Kotak Mahindra

Bank- 140000, M/s Alphonsa Industries (cr.)- 30500, 0/s Rent- 25500, Machinery-

185000, Cash- 24000, M/s Srijan Tradin&s (Dr.)- 26000, M/s Vishal Retail

(Dr.)- 11000, Profit & Loss A/c- 25000.

7. Employee's PF Deduction Pay Head:

The Complexity of statutory

calculation has now become flexible in Tally Prime. For our statutory Pay Heads

Type Tally provides predefined values. Here we seen an example of creating

Employees PF Contribution.

Select Pay Head Type as per your

statutory need from list and then statutory pay type. The rest of options are

similar to computation-based pay head shown as below.

Employees

Deduction Pay Head

|

Pay Head |

Under |

Pay Head Type |

Statutory Pay Type |

Calculated on |

Amount Up to |

value |

|

Employees PF

Deduction @ (12%) |

Current Liabilities |

Employees'

Statutory Deductions |

PF Account |

Basic |

15000 |

12% |

|

>15000 |

1800 |

|||||

|

Employees ESI

Deduction @(0.75%) |

Current Liabilities |

Employees'

Statutory Deductions |

Employee State Insurance |

On Current Earnings total |

---------- |

0.75% |

PF &

ESI

The Employees provident fund and miscellaneous provision

act, 1952 is a social security measure aimed at promoting and securing the

well-being of the employees by way of provident fund, family pension anc

insurance to them. The object of the Act is the institution of the compulsory

contributory provident fund to the employees to which both the employee and

employer would contribute. The employee's provident fund scheme was accordingly

framed under the act and it came in to effect from 1-11-1952. The provisions of

the employee's provident fund and Misc. Provision Act, 1952 extends to whole of

india except the state of Jammu & kashmir.

Applicability-PF

The act shall apply to every establishment which is a

factory engaged in any industry and employing 20 or more persons. All employees

in such factory or establishment including contract labour but excluding casual

labour and receiving wages (Basic Wages+ DA) up to! 15000 per month will be

regulated by the provisions of the Act. Trainee and apprentices are also

included in determination of the numerical strength. Once the Act applies to

any establishment, it shall continue to be governed by the fact that the number

of employees working therein have subsequently fallen below 20.

Wages

Basic wages include all emoluments earned by an employee

while on duty or on leave/holidays with wages in accordance with the terms of

contract of employment and paid/payable to him in cash. But the following are

excluded from 'basic wages':

(i)

The cash value of any food concession;

(ii)

Any

dearness allowance or any other allowance by whatever name called paid to the

employee on account of rise in cost of living or in respect of work done by him

in such employment, for es, HRA, OT, bonus, commission etc.; and

(iii)

Any presents made by the employer.

Membership

An employee on his own, cannot become an EPF Member. To

become an EPF member, he has to work in an establishment which is covered under

EPF and MP ACT,1952. If 20 or more employees are working in an establishment,

EPFO will cover that establishment. If the employer and the employees of an

establishment desires, that establishment can voluntarily opt for EPF coverage

even if the employees employed therein is less than 20.

If the establishment is not covered and at least 20

employees are working in that establishment, the employee can approach EPFO to

cover it.

Contributions

Employees Provident fund scheme takes care of the members at

the time of retirement, medical care, housing, family obligations, education of

children, finance of insurance policies etc. The employee may contribute 12% of

the wages (Basic wages +DA). If the employee so desires, he may opt to

contribute a higher rate also. However, the employer does not have to pay the

voluntary contribution over and above the statutory rate. The employer's

contribution of 12% shall be up 8.33% of wages towards Employee' Pension Scheme

and the balance 3.67% towards the provident fund. The employer's contribution

to the Employees deposit linked insurance scheme will be 0.5% of the wages. In

addition, the employer has to pay @ 0.5%of wages (Min Rs 500) towards

administrative charges of EPF. The employee does not have to make any

contribution to the pension fund account. These amounts must be paid within 15

days from close of every month with the PF Commissioner into the respective

accounts maintained with the State bank of India. If the amount is not paid,

employer is liable to pay "damages". In additional, criminal

prosecution can also be launched.

PF Contribution

|

Employee Contribution |

Employer Contribution |

|

12%of wages

(3.67% goes to EPF & 8.33% goes to pension fund.) |

|

|

12% of wages

goes to EPF |

Administrative

charges 0.5% of wages

for PF subject to a minimum of Rs 500 EDLI

Charges 0.5% of wages |

For Example, the monthly earning of an employee is as

follows:

Basic Wages 8000

DA 4000

HRA 4500

Overtime 1400

In this case, Employee's contribution to PF will be — 1440

(12% of Rs. 12000).

Eg. Employer's contribution = 1440 (12% of Rs. 12000) out of

which Rs. 440.40 (3.67% of Rs. 12000) will go to EPF and the remaining Rs.

999.60 (8.33% of 12000) will go to the pension fund. Besides that, Employer has

to contribute Rs. 60 (0.5% of Rs. 12000) and to Pay Rs. 60 (0.5% of Rs. 12000)

as EDLI charges. So the employer has to pay a total of rupees 1560(999.60+

440.40+60+60). The employee will get rupees 16460 (17900 —1440) as net salary.

Filling of Returns

An employee at the time joining will give declaration to the

employer in Form 2. A return in the prescribed form file in respect of

employees qualifying to be member of the fund for the first time during the

month, shall be filed 15 days of the closer of every month be sent of the CPFC.

A monthly return of contribution in the prescribed Form12A has to be filled

with the commissioner within 25 days of the close of the month. Annual return

of contribution in Form3A & 6A reflecting the employer and employee contribution

in respect of each employee is to be submitted within one month of the close of

the period of currency to the commissioner.

|

SI. NO. |

Form details |

Form Number |

Submission Date |

Submitted to |

|

1 |

Declaration form for new joinee |

2 |

At the time of joining |

PF Office |

|

2 |

Monthly contribution of the employer &

employees in chalan for previous month |

Challan |

Before 15th of every month |

State bank of

India |

|

3 |

Return of employee qualifying during the

last month |

5 |

Before 15th

of every month |

PF Office |

|

4 |

Return of the

employees lived the organization |

10 |

Before 15th

of every month |

PF Office |

|

5 |

Monthly return |

12A |

Before 15th of every month |

PF Office |

|

6 |

Annual return |

3A & 6A |

Before 30th Apri |

l PF Office |

|

7 |

Transfer to PF Account |

13 |

At the time of new recruitment |

PF Office |

|

8 |

Final Settlement |

19, 10C, 100 |

At the time of living |

PF Office |

Withdrawal of money form EPF

To withdrawal money from EPF account you have to either —

Resign or retire from the establishment and apply for the settlement of PF in

Form — 16.

How to get Pension

If you have attained the age of 50

years or more, and if you have completed a total service of 10 years or more

and if you are not getting any other EPF pension then you have to apply in Form

10D at the EPF office where you last work through your last employer.

If you want to draw pension from a

different place, you have to furnish appropriate Bank / Post Office address in

the application from.

Pension is distributed through Post Office or through some

designated bank only (e.g.: Indian Bank, SBI, Indian Overseas Bank, HDFC Bank,

ICICI and UTI Bank).

Four situations when pension can

be applied for:

|

1. On

superannuation: Age 58 years or more and at least ten years of service |

The member can continue in service while

receiving this pension. On attaining 58 Years of age, an EPF member cease to

be a member of EPS automatically. |

|

2. Before

superannuation |

Age between 50 and 58 years at least ten

years of service. The member should not be in service. |

|

3. Death of

the member |

Death while in service or Death while not in

service. |

|

4. Permanent

disability |

Permanently and totally unfit for the

employment which the member was doing at the time of such disablement. |

No pensioner can receive more than one EPF Pension.

Transfer of Account

An employee has to apply in from 13 (Received) thilough the

new employer at the EPF office from which transfer is sought clearly stating

the new and old EPF Numbers. He has to obtain new EPF number from his New

Employer. New EPF Number will be allotted by new employer, not EPFO.

Employees' Deposit Linked Insurance (EDLI) Scheme

On death of a member, the Family Members or Nominee (whoever

has the entitlement to claim Provident Fund amount) can claim for EDLI Benefit.

Maximum amount payable is Rs 60,000. No amount is taken from the Member for

this facility. Employer contributes for this.

The minimum monthly pension will be Rs 1,000 per month

Under the new rules, widow of a member will get a minimum

monthly pension of Rs 1,000. For children, it fixed at Rs 250 and the orphans

it is Rs 750 per month. In addition, to arrive at pension, salary will be

average of 60 months last drawn salary instead of earlier rule of last 12

months' average salary.

Insurance coverage to member Increased to Rs 3,00,000

Earlier each member who is part the EPF scheme had an

insurance coverage of Rs 1,56,00. This insurance coverage has now risen to Rs

6,00,00.

Employees' State Insurance (ESI)

The main objective of the Employees' State Insurance Act,

1948 is to provide to the workers medical relief, sickness cash benefits,

maternity benefits to women workers, pension to the dependents of deceased

workers and compensation for fatal and other employment injuries including

occupational diseases, in an integrated from through a contributory fund. Where

a workman is covered under ESI Scheme, no compensation could be claimed from

his employer under the Workmen's Compensation Act in respect of employment

injury sustained by him.

Applicability

ESI Act, 1948 is a applicable to:

a) All factories (non seasonal)

using power and employing 10 or more pension;

b) Factories not using power

employing 20 or more persons;

c) Shops, hotels, restaurants,

cinemas, motor transport undertakings and newspaper establishments employing 20 or more

persons.

ESI Act has been implemented area wise b staves. Now it has

been implemented in all the states expect Nagaland, Manipur, I r ipur a,

Sikkim, Arunachal P(adesh and Mizoram. It is also implemented in union

territories- Delhi, Chandigarh and Pondicherry.

Employees covered

Every employee (including casual and temporary employees),

whether employed directly or through a contractor, who is in receipt of wages

up to Rs 21,000 p.m. is entitled to be insured under the E.S.I. Act However,

apprentices engaged under the Apprentices Act are not entitled to the E.S.I.

Benefits. Coverage of part time employees under the ESI Act will depend on

whether they have contract of service or contract for service with the

employer. The former is covered whereas the latter are not covered under the

ESI Act.

Contribution

E.S.I. Scheme being contributory in nature, all the

employees in the factories or establishments to which the Act applies shall be

insured. The contribution payable to the Corporation in respect of an employee

shall comprise of employer's contribution and employee's contribution at a

specified rate. The rates are revised from time to time. Currently, the

employee's contribution rate is 0.75% of the wages and that of employer is

3.25% of the total wages. Employees in receipt of a daily wages up to Rs 100

are exempted from payment of contribution. Employers will however contribute

their own share in respect of these employees.

An employer is liable to pay his contribution in respect of

every employee and deduct employees' contribution from wages bill and shall pay

these contributions to the Corporation within 21 days of next month. Before

payment, the employer has to log on to the website www.esic.in and to submit

the contribution details for that month. Payment can be online (through SBI Net

Banking) or by cash / Cheque / DD. Cheque should be in favour of "SBI —

A/c -ESIC A/c No. 1".

|

Employee's

salary |

Employee Contribution |

Employer Contribution |

|

Rs

2,200-21,000 |

0.75% of Gross Salary |

3.25% of Gross Salary |

|

less than Rs

2,200 |

Nil |

ESI limit has increased to Its 21,000 from Its 15,000

applicable from 1st Oct 2016.

For example, the monthly earning

of an employee is as follows:

Rs

Basic Wages 5,000

DA 2,500

HRA 2,000

In this case, Employee's deduction to ESI will be Its 71.25

(0.75% of Its 9,500) and employer's contribution will be Its 308.75 (3.25% of

Rs 9,500).

Contribution Period and Benefit Period

There are two contribution periods each of six months'

duration and two corresponding benefit also of six months' duration as under:

|

Contribution

Period |

Corresponding Cash Benefit period |

|

1" April

to 30th Sept |

1" January to 30th June of the

following year |

|

1" Oct.

to 31" March |

1" July to 31" December of the

following year |

Benefits provided to the employees under the provisions

of ESI Scheme.

|

Different Benefits |

Benefits as

provided by ESI Corporation |

|

Medical Benefit (Treatment) |

Full Medical

facilities with hospital treatment to the insured person & his family

members. |

|

Sickness Benefits |

Sickness

Benefit in the form of cash compensation at the rate of 70 per cent of wages

is payable to insured workers during the periods of certified sickness

benefit for a maximum of 91 days in a year. In order to qualify for sickness,

benefit the insured worker is required to contribute for 78 days in a

contribution of 6 months. |

|

Permanent Disablement Benefit |

The benefit is

paid at the rate of 90% of wage in the form of monthly payment depending upon

the extent of loss of earning capacity as certified by a Medical Board. |

|

Dependent Benefit |

Paid at the

rate of 90% of wage in the form of monthly payment to the dependents of a

deceased Insured person in cases where death occurs due to employment injury

or occupational hazards. |

|

Maternity Benefit |

Maternity

Benefit for confinement/ pregnancy is payable for three months, which is

extendable by further one month on medical advice at the rate of full wage

subject to contribution for 70 days in the preceding year. |

|

Funeral Expenses |

10,000 in lump

sum. |

8. Employer's Contribution Pay Heads:

|

Employees Contribution Pay Head |

|||||||

|

Pay Head |

Under |

Pay

Head Type |

Statutory Pay Type |

Calculated on |

Amount

Up to |

value |

|

|

Emplover's EPS @ 8.33% |

Indirect

Expense |

Employer's

Statutory Contribution |

EPS Account

(A/c No. 10) |

basic |

15000 |

8.33% |

|

|

>15000 |

1249.50 |

||||||

|

Employer EPF @ 3.67% |

Indirect

Expense |

Employer's

Statutory Contribution |

PF Account

(A/c No. 1) |

Employees PF Deduction @12% Employer's EPS 8.33% |

---- |

100% |

|

|

PF Adrnin Charges @ 0.5% |

Current

Liabilities |

Emplover's

Other charges" |

Admin Charges

(A/c No. 2) |

PF Gross |

----- |

0.5% |

|

|

EDL1 Contribution 10.5% |

Current

Liabilities |

E.mplover's

Other charges |

EDL1Contribution (A/c No. 21) |

PF Gross |

------ |

0.5% |

|

|

Employers ES1

4 3.73% |

Indirect Exp |

Employer's

Statutory Contribution |

Employer State

Insurance |

Current

Earning Total |

------- |

3.75% |

|

9. Other Important Pay Head

Creation :

Salary Payable à

Current Liabilities

Pf Payable à

Current Liabilities

ESI Payable à

Current Liabilities

10. now create ledger:

Pf Admin Charges à

Indirect Expenses

11. Defining Salary Structure

Pay structure of employees is

defined through different. The little differences can be altering by individual

salary details screen.

GOT> Alter> Define Salary

|

Salary Structure |

|

|||||||||

|

Employee |

Basic |

HRA

40% on Basic |

Conveyance |

Incentive |

Overtime/hr. |

PF |

ESI |

|||

|

Anup Kundu |

Rs.14,800.00 |

Computed |

Rs.2,500.00 |

User Defined |

Rs.100.00 |

Computed |

Computed |

|

||

|

Neelu Dutta |

Rs.5,200.00 |

Computed |

Rs.1,400.00 |

N/A |

Rs.$0.00 |

Computed |

Computed |

|

||

|

Rimjhim Gupta |

Rs.14,500.00 |

Computed |

Rs.1,500.00 |

User Defined |

Rs.150.00 |

Computed |

Computed |

|

||

|

Gaurav Das |

Rs.3,900.00 |

Computed |

Rs.1,950.00 |

N/A |

Rs.200.00 |

Computed |

Computed |

|

||

|

Koyel Ghosh |

Rs.4,600.00 |

Computed |

Rs.2,000.00 |

N/A |

Rs.120.00 |

Computed |

Computed |

|

||

In Define Salary Press F12:

Configuration

Allow to Override Slab Percentage : Yes

Allow copy from Employee : Yes

Show Pay Head Type : Yes

Show Calculation Type : : Yes

Show Computed On : Yes

Note.1. Same as create Salary

Details for other Employees.

2.Now Change the Date of Retirement

of Neelu Dutta to 1.8.2020.

Voucher: Recording Attendance/

Production

This voucher allows you to enter

attendance, overtime, leave or production details.

Here we pass the attendance

voucher first.

1.

Attendance/ Production Voucher:

GOT> Voucher> F10:More Vouchers>

Attendance> Press Ctrl+F

Autofill

Type of transaction Attendance : Autofill

Voucher Date : 31-7-2020

Employee Category : Head Office

Employee/Group : All Items

Auto

Fill Values

Attendance : Production Type Present

Default Value to Fill : 31

(Value entered above will be prefilled for all

the Employees)

Sort by : Employee Name

Absent &

leave entry:

Production

entry:

2. Processing for Payroll Voucher:

GOT> Vouchers> Ctrl+F4

(Payroll Voucher)> F2(31-7)> Press Ctrl+F4

Autofill

Type of transaction Payroll : Autofill

Process for : Salary

From (blank for beginning) : 1.7-2020

To (blank for end) : 31-7-2020

Employee Category : Head Office

Employee/Group : All Items

Sort by : Employee Name

Payroll/bank/cash/Ledger : Salary Payable

Process:

user defined

3.

Processing For Employer's ESI

Contribution:

GOT> Voucher> Ctrl+F4> Ctrl+F

Autofill

Type of transaction : Payroll Autofill

Process for : ESI Contribution

From (blank for beginning) : 1-7-2020

To (blank for end) : 31-7-2020

Employee Category : Head Office

Employee/Group : All Items

Sort by : Employee Name

Payroll/Bank/Cash : Ledger ESI Payable

4.

Now Salary Payment :

GOT> Voucher> F5 (Payment)>

F2 (1-8)> CtrI+F

Autofill

Type of transaction :

Payroll Autofill

Process for :

Salary Payment

From (blank for beginning) : 1-7-2020

To (blank for end) : 31-7-2020

Voucher Date

:

1-8-2020

Employee Category :

Head Office

Employee/Group :

All Items

Payroll Ledger :

Salary Payable

Bank/Cash Ledger :

Hdfc Bank

Use Mode of Payment/Transaction Type : No

5.

Now PF Payment to EPFO:

GOT>

Voucher> Press F5 > Press CTRL+F

Autofill

Type of transaction : Payroll Autofill

Process for : PF Challan

From (blank for beginning) : 1.7-2020

To (blank for end) : 31.7-2020

Voucher Date : 1-8.2020

Employee Category : Head Office

Employee/Group : All Items

Payroll Ledger : PF Payable

Bank/Cash Ledger : HDFC Bank

6.

Now Pay ESI to ESIC Department:

GOT>

Voucher> F5 (Payment)> CTRL+F

Autofill

Type of transaction :

Payroll Autofill

Process for :

ESI Challan

From (blank for beginning) : 1-7-2020

To (blank for end) : 31-7-2020

Voucher Date :

1-8-2020

Employee Category :

Head Office

Employee/Group : All

Items

Payroll Ledger :

ESI Payable

Bank/Cash Ledger :

HDFC Bank

-Reporting-

Salary

Payment Advice:

Now a day's

most of companies using direct crediting employee's salary in their bank

accounts. For direct crediting the salaries company need to send for the same

with payroll details in tally prime payment advice can be generated and print

directly at ease.

To print the

payment Advice letter:

GOT>

Display> Payroll Report> Payment Advice

Payroll Practice

Payment Advice

The

Manager

Hdfc Bank 31-Mar-21

Dear Sir.

Payment Advice from Payroll Practice

A/c No. for period 1-Aug-20 to 31-Aug-20

Please make

the payroll transfer from above account number to the below mentioned account

numbers towards employee salaries:

|

SI. No. |

Name

of the Employee |

Account

No. |

Amount

|

|

1. |

Neelu

Datta |

162014589236025 |

7. .90

|

|

2. |

Anup

Kundu |

164851203148523 |

23,527.90

|

|

3. |

Rimjhim

Gupta |

164852013245870 |

22.857.50

|

|

4. |

Gaurav

Das |

168594625630124 |

8.43142

|

|

5. |

Koyel

Ghosh |

168594652301458 |

9,003.79 |

|

Total |

|

71,811.51 |

|

|

Amount (in words) : INR Seventy One Thousand Eight

Hundred Eleven and Fifty One paise |

|||

Yours Sincerely

For Payroll Practice

Authorized Signatory

Print and

View Pay Slip:

To Provide pay Slip to employees, you can view and print it

from Tally.

GOT> Display> Payroll Reports> Pay Slip

Post a Comment