Activating GST De- active other Taxes (Vat, Central Excise.

Service Tax), Master Creation GST

Related, Purchase Goods (local), Invoice Printing, GST

Reports

![]()

Activating GST

Tally solution has released the new version Tally Prime in which we can able to pass

transaction related to GST. To use Tally Prime fro GST

compliance, you need to activate the GST feature.

Once activated, GST- related feature are available in

ledgers, stock items, transactions, and GST returns can be generated.

To Activate GST you need to act:

> At first create a New Company Name "Swastik GST-

Your Name" for 2025-26

Now GST detail Screen will appear and we need to fill the

details:

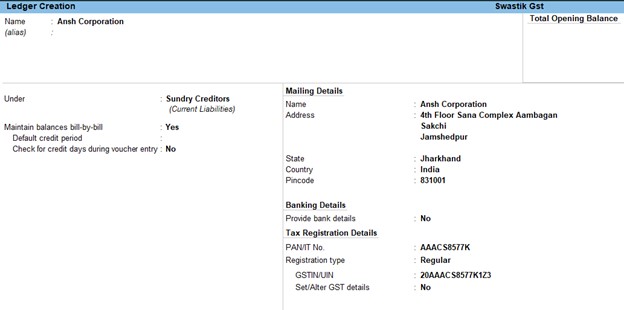

Master Creation- GST Related

Purchase Ledger

Sales Ledger

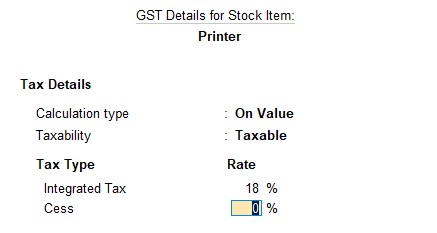

Create same as Led Monitor and use original HSN Code

Purchase Goods (Local)

On 1-7-2025 Company purchase 50 pcs Printer @4000/- and 50

pcs LED monitor @3000/- with 18% GST from a regular dealer Ansh corporation of

jamshedpur.

Sale Goods (Local)

On 02-07-2025 compnay sold 35 pcs Printer @ 6000/- and 35

pcs Monitor @5000/- to RKDK a regular dealer of Jamshedpur.

Got> Accounting Voucher> Press F8

Create Bill number

Alter à

Voucher type à

Sales

Use advanced configuration—yes

Gst Reports

GSTR-1

GOTàDisplay

More Report àGST

Report àGSTR-1(Sales)

GSTR-2

GOTàDisplay More Report àGST Report àGSTR-2(Purchase)

Post a Comment